Contribution Margin vs. Gross Profit: Why Variable Costing Wins for Management Reporting

Contribution Margin vs. Gross Profit: Why Variable Costing Wins for Management Reporting Meta description: Discover why contribution margin under variable costing offers better insights for internal management than gross profit under absorption costing. When comparing contribution margin vs gross profit, it’s important to understand that financial accounting primarily serves investors and regulators. Therefore, external reporting […]

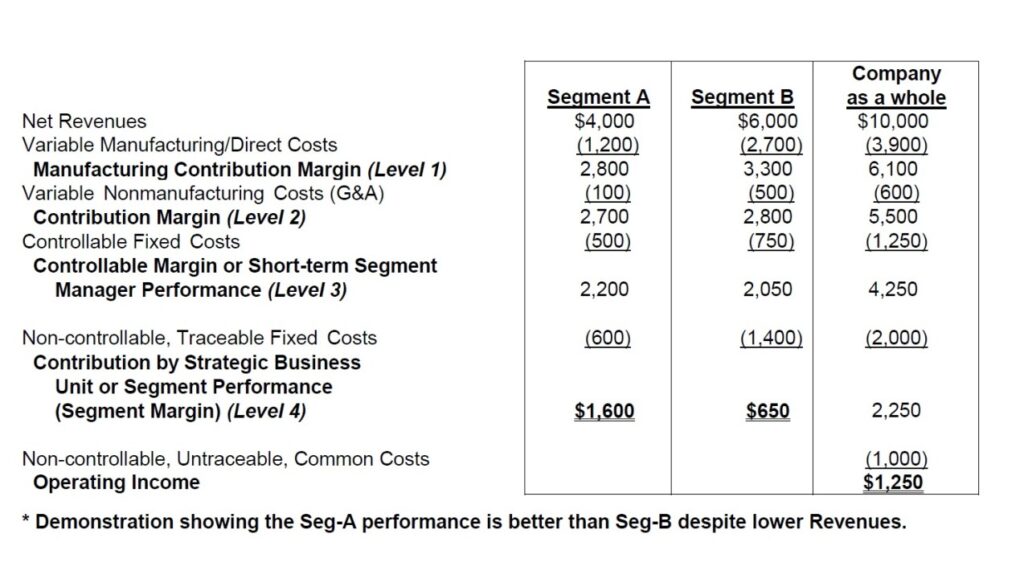

Driving Performance with Contribution Margin Analysis

Improve your skills in performance management with management accounting! Learn how performance measures can boost both individual and organizational success, going beyond traditional financial accounting. Understand the key roles of cost centers, profit centers, and responsibility centers in measuring performance. Explore the difference between controllable and uncontrollable costs, and how this knowledge can help managers achieve better results. With insights into the Contribution Income Statement and controllable margins, you’ll get the tools to make better decisions and enhance performance. Join us on this journey to deepen your understanding of management accounting!

A Financial Performance Framework

Turning Around Loss-Making Business Segments As large organizations expand into diversified business segments, not all units perform equally. Some segments quietly dilute group profitability despite healthy revenue streams. To manage capital effectively and maximize enterprise value, financial leaders must take a structured approach to segment-level performance evaluation. This article outlines how to assess underperforming or […]

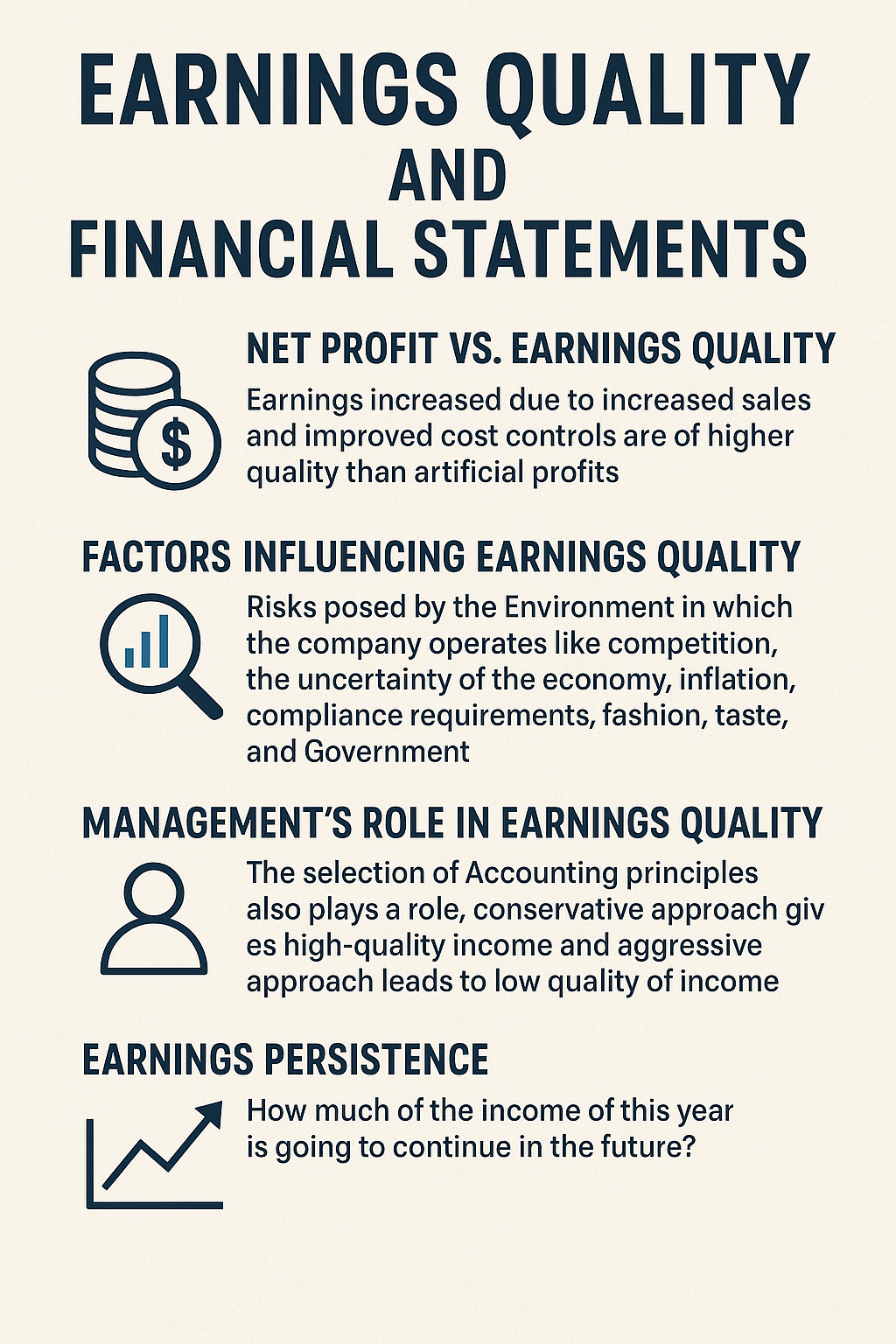

Understanding Earnings Quality and Financial Statements

When analyzing a company’s financials, it’s easy to focus on net profit and assume all is well. However, net profit can be misleading due to one-off gains or creative accounting. Understanding earnings quality is crucial, as it reveals the true health of a company’s profits, distinguishing between sustainable earnings and those inflated by temporary factors. Whether you’re an investor, analyst, or student, grasping earnings quality can significantly impact your decision-making. Discover how to assess it and its implications for long-term financial stability.

Why 10% Across-the-Board Cuts Rarely Work — And What to Do Instead

Are you tired of ineffective cost cuts that leave your organization struggling? Discover why blanket reductions fail and how Activity-Based Management (ABM) provides a smarter approach to cost optimization. Learn to focus on managing activities that drive costs and enhance value. With tools like Activity-Based Costing (ABC), identify true cost drivers and redesign processes for sustainable profitability. Transform your financial strategy today!

Earnings Quality and Financial Statements

We often look at Net Profit as a measure of earnings of the company. Earnings Increased due to increased sales and improved cost controls are of a higher quality than artificial profits created by inflation of inventory or other asset prices. Factors that determine earnings quality are; Risks posed by the Environment in which the […]

Performance Management through Management Accounting

Management accounting establishes performance measures of individuals and organisation. Performance measurement cannot be addressed by financial accounting only and hence tools devised by management accounting need to be deployed to achieve segment’s and/or manager’s performance measures in a given period. A Responsibility centre is any part of an organization. It may be a product line, […]