Contribution Margin vs. Gross Profit: Why Variable Costing Wins for Management Reporting

Contribution Margin vs. Gross Profit: Why Variable Costing Wins for Management Reporting

Meta description: Discover why contribution margin under variable costing provides better insights for internal management than gross profit under absorption costing.

Financial accounting serves investors and regulators. That’s why external reporting (GAAP/IFRS) requires absorption costing, which culminates in the familiar Gross Profit line. Essential for the financial statements—yes. But for internal decisions, Gross Profit can mislead.

Managers need a line of sight into cost behavior, volume sensitivity, and real economics of product and channel choices. This is where variable costing—and its core metric, contribution margin—outperforms gross profit as a management lens.

Why Gross Profit Can Mislead

- Fixed overhead is absorbed into inventory. When production exceeds sales, a portion of fixed costs is capitalized, making profits look healthier even without extra sales.

- Volume bias. Managers can inflate reported profit by producing more, tying up cash and space in inventory.

- Behavior is hidden. Gross Profit doesn’t separate variable and fixed costs, limiting CVP and break-even insights.

Key point: Gross profit is excellent for external reporting, but it can distort managerial decisions when inventory moves independently of demand.

Variable Costing: The Clearer Lens

Under variable costing, only variable manufacturing costs are assigned to units; fixed manufacturing costs are expensed in the period. This yields the contribution margin:

Contribution Margin = Sales − Variable Costs

- Clarity of cost behavior (variable vs. fixed) for sensitivity and scenario analysis.

- Break-even ready: Directly supports cost–volume–profit analysis and operating leverage.

- Decision relevance: Clear view of pricing, product mix, and make/buy choices.

- No inventory distortion: Overproduction doesn’t artificially boost income.

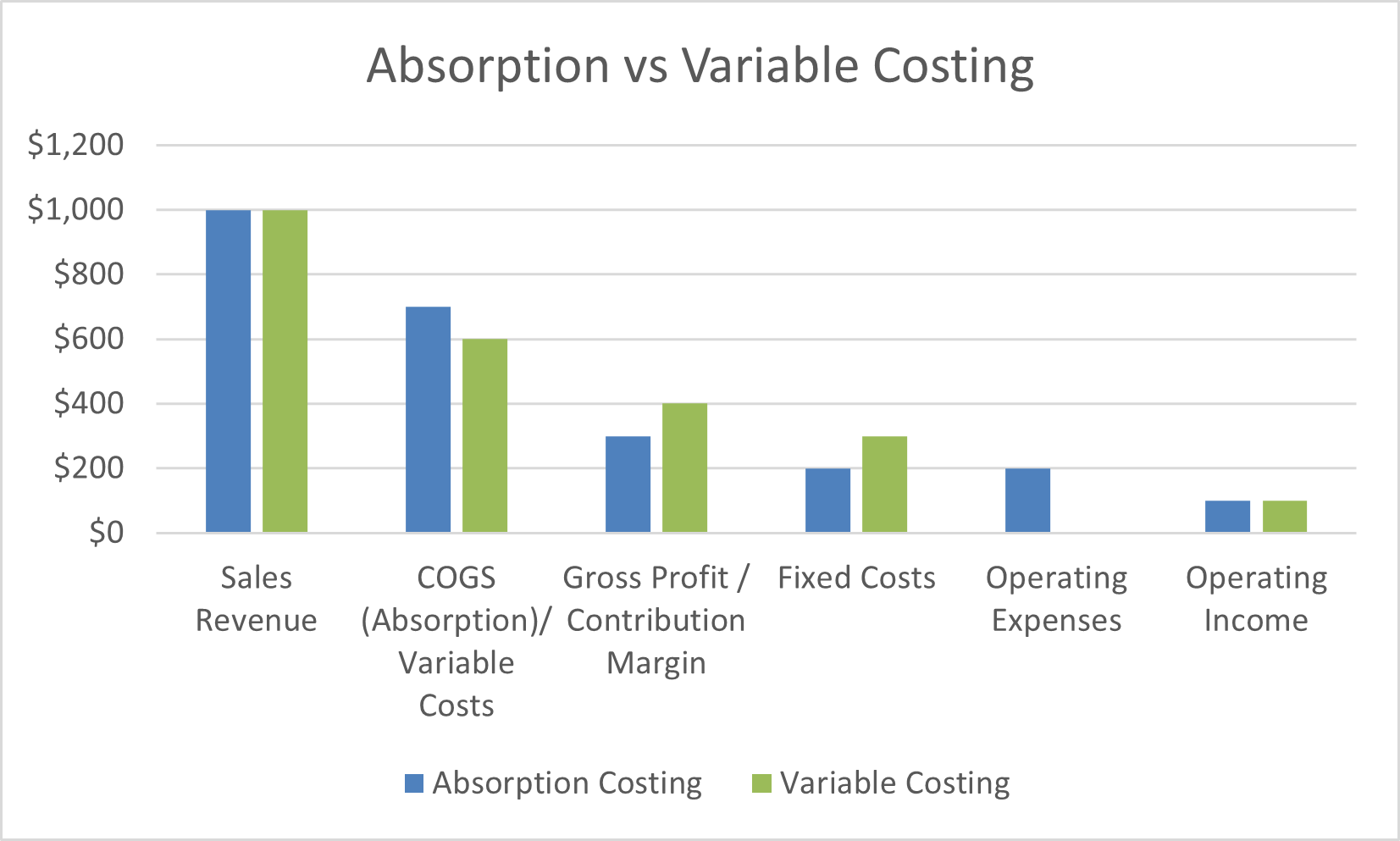

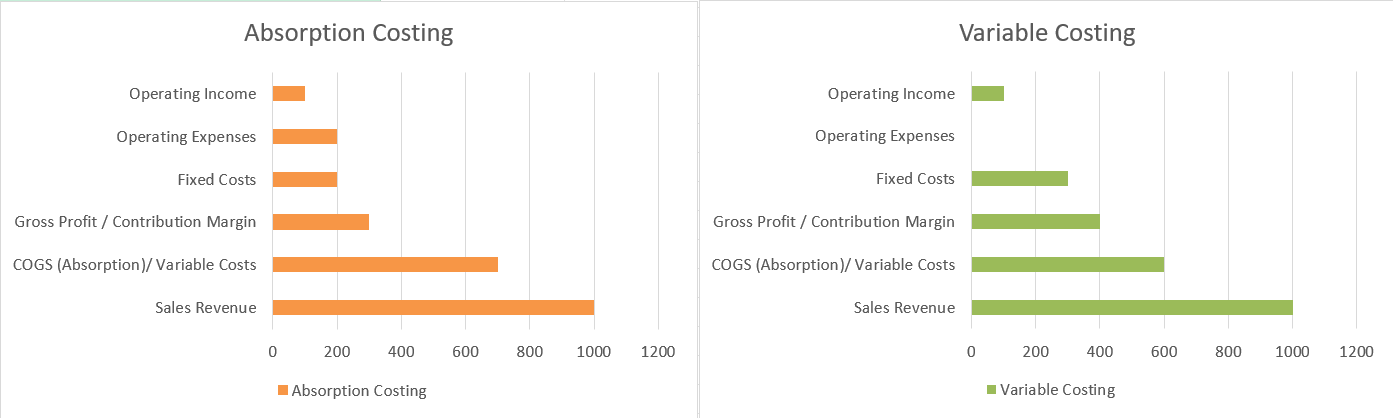

Illustration (Simplified)

Assume a widget with price 100, variable cost 60, and monthly fixed manufacturing overhead 120,000. In Month 2 the factory overproduces relative to sales. Under absorption costing, some fixed overhead is parked in inventory—reported gross profit rises. Under variable costing, it doesn’t.

Side-by-Side Mini P&L

Use this visual when explaining the formats to non-finance stakeholders.

The Bigger Picture: From Cost to Value

Traditional costing systems—absorption, ABC, TDABC—share weaknesses like pooling and allocations that can cloud insight. Modern approaches such as Activity Value Management (AVM®) link costs to activities and stakeholder value (customer loyalty, employee engagement), with bidirectional audit trails and prescriptive analytics. Consider a dual path: adopt contribution margin for internal reporting now, while exploring value-centric frameworks for deeper performance improvement.

Conclusion: Dual Reporting for Better Decisions

- Absorption costing → external compliance and investor communication.

- Variable costing → day-to-day managerial insight via contribution margin.

Contribution margin illuminates how revenues, variable costs, and fixed expenses interact—making it a superior guide for planning, pricing, and performance management.

Next: Build your management packs around contribution margin, and add guardrails that prevent profit inflation via overproduction.

© 2025 ZubairSyed.com