Contribution Margin vs. Gross Profit: Why Variable Costing Wins for Management Reporting

Meta description: Discover why contribution margin under variable costing offers better insights for internal management than gross profit under absorption costing.

When comparing contribution margin vs gross profit, it’s important to understand that financial accounting primarily serves investors and regulators. Therefore, external reporting under GAAP or IFRS uses absorption costing, which leads to the familiar gross profit line. While this is essential for financial statements, it can mislead internal decision-making.

Managers need a clear view into cost behavior, volume sensitivity, and the economics behind product and channel choices. As a result, variable costing—with its core metric, contribution margin—often outperforms gross profit for internal decision-making.

Why Gross Profit Can Mislead

- Inventory distortion: The system absorbs fixed overhead into inventory. As a result, when production exceeds sales, it inflates reported profit—even without additional revenue.

- Volume bias: Managers may produce more than necessary. Consequently, they can report higher profits while tying up capital and storage.

- Lack of behavior clarity: Gross profit combines variable and fixed costs, which limits its usefulness for CVP and break-even analysis.

Key point: Gross profit works well for external reporting but can distort internal decisions—especially when inventory and demand are not aligned.

Variable Costing: The Clearer Lens

Under variable costing, only variable manufacturing costs are assigned to units. Meanwhile, fixed manufacturing costs are expensed in the period they are incurred. This results in the contribution margin:

Contribution Margin = Sales − Variable Costs

- Clarity of cost behavior: Separates variable from fixed costs, supporting scenario and sensitivity analysis.

- Break-even ready: Simplifies cost–volume–profit (CVP) analysis and highlights operating leverage.

- Relevant to decisions: Offers better insight for pricing, product mix, and make/buy evaluations.

- No inventory distortion: Overproduction doesn’t create artificial profit spikes.

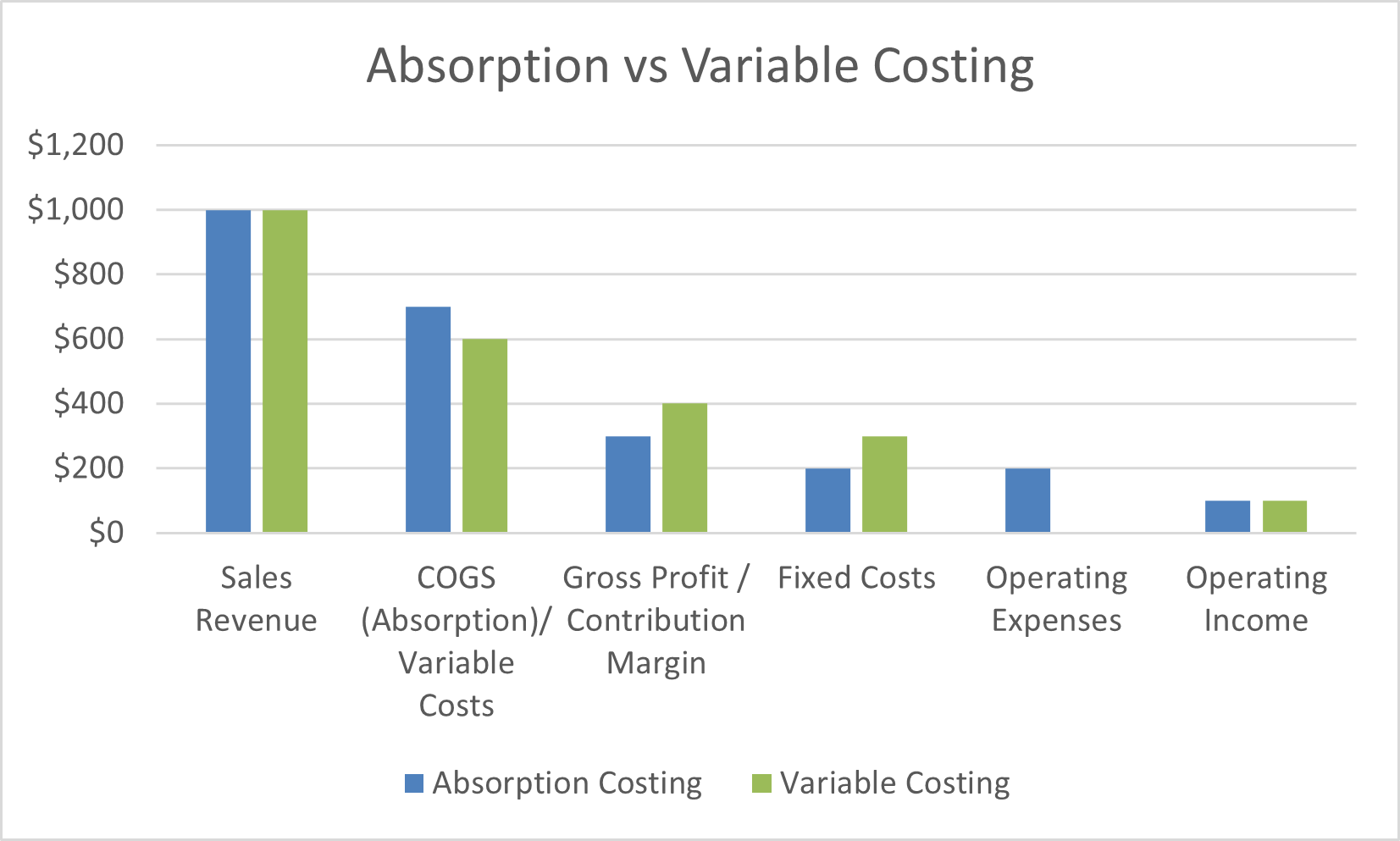

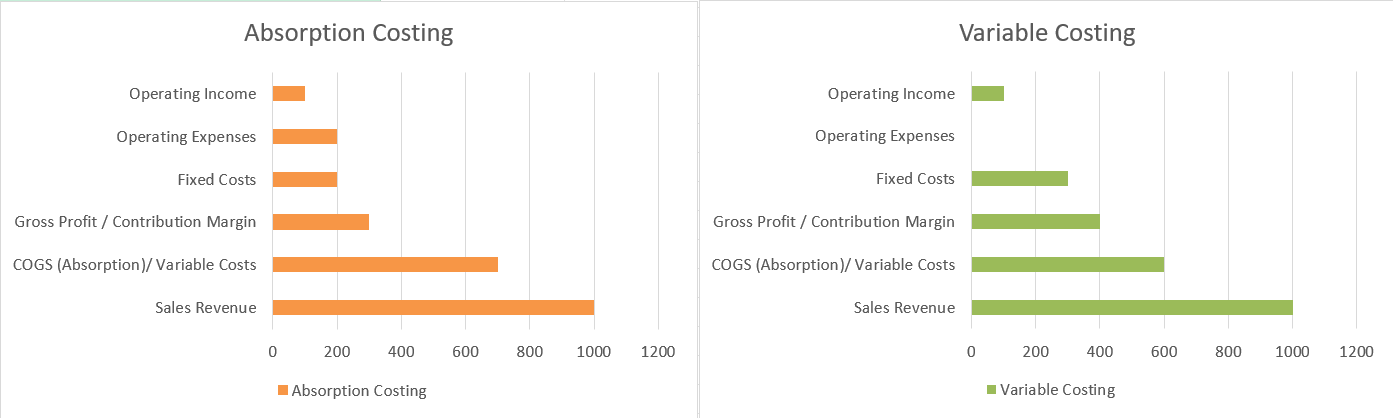

Illustration (Simplified)

Let’s assume a widget with price 100, variable cost 60, and monthly fixed overhead of 120,000. In Month 2, the factory overproduces. Under absorption costing, some fixed overhead gets stored in inventory, which inflates gross profit. In contrast, under variable costing, this doesn’t happen—contribution margin stays accurate.

Side-by-Side Mini P&L

Use this visual when explaining the formats to non-finance audiences. It helps communicate the differences clearly and quickly.

The Bigger Picture: From Cost to Value

Traditional methods—like absorption, ABC, and TDABC—have limitations. They often rely on cost pools and indirect allocations, which obscure the true nature of value creation. Instead, modern methods like Activity Value Management (AVM®) link costs directly to stakeholder value such as customer loyalty and employee engagement.

Therefore, companies should adopt contribution margin reporting for short-term clarity while also exploring advanced frameworks like AVM for long-term transformation.

Conclusion: Dual Reporting for Better Decisions

- Absorption costing → Required for compliance and investor communication.

- Variable costing → Preferred for internal management, pricing, and operations decisions.

In conclusion, contribution margin offers a sharper lens on the interaction between revenues, variable costs, and fixed expenses. As a result, it better supports planning, performance management, and profit integrity.

Next: Start building your internal reports and dashboards around contribution margin. Also, introduce policies that prevent overproduction aimed at inflating reported profit.

© 2025 ZubairSyed.com | Let’s work together